Elon Musk’s polygonal pickup is a polarizing sales flop that’s missed the billionaire’s volume goal by a staggering 84%. And there’s no sign that things are improving.

The list of famous auto industry flops is long and storied, topped by stinkers like Ford’s Edsel and exploding Pinto and General Motors’s unsightly Pontiac Aztek crossover SUV. Even John Delorean’s sleek, stainless steel DMC-12, iconic from its role in the “Back To The Future” films, was a sales dud that drove the company to bankruptcy.

Elon Musk’s pet project, the dumpster-driving Tesla Cybertruck, now tops that list.

After a little over a year at market, sales of the 6,600-pound vehicle, priced from $82,000, are laughably below what Musk predicted. Its lousy reputation for quality–with eight recalls in the past 13 months, the latest for body panels that fall off–and polarizing look made it a punchline for comedians. Unlike past auto flops that just looked ridiculous or sold badly, Musk’s truck is also a focal point for global Tesla protests spurred by the billionaire’s job-slashing DOGE role and MAGA politics.

“It’s right up there with Edsel,” said Eric Noble, president of consultancy CARLAB and a professor at ArtCenter College of Design in Pasadena, California (Tesla design chief Franz von Holzhausen, who styled Cybertruck for Musk, is a graduate of its famed transportation design program). “It’s a huge swing and a huge miss.”

“I do zero market research whatsoever.”

Elon Musk, November 2019

Judged solely on sales, Musk’s Cybertruck is actually doing a lot worse than Edsel, a name that’s become synonymous with a disastrous product misfire. Ford hoped to sell 200,000 Edsels a year when it hit the market in 1958, but managed just 63,000. Sales plunged in 1959 and the brand was dumped in 1960. Musk predicted that Cybertruck might see 250,000 annual sales. Tesla sold just under 40,000 in 2024, its first full year. There’s no sign that volume is rising this year, with sales trending lower in January and February, according to Cox Automotive.And Tesla’s overall sales are plummeting this year, with deliveries tumbling 13% in the first quarter to 337,000 units, well below consensus expectations of 408,000. The company did not break out Cybertruck sales, which is lumped in with the Model S and Model X, its priciest segment. But it’s clear Cybertruck sales were hurt this quarter by the need to make recall-related fixes, Ben Kallo, an equity analyst for Baird, said in a research note. Tesla didn’t immediately respond to a request for comment.

The quarterly slowdown underscores the fact that when it comes to the Cybertruck, results are nowhere near the billionaire entrepreneur’s carnival barker claims.

“Demand is off the charts,” he crowed during a results call in November 2023, just before the first units started shipping to customers. “We have over 1 million people who have reserved the car.”

In anticipation of high sales, Tesla even modified its Austin Gigafactory so it could produce up to 250,000 Cybertrucks a year, capacity investments that aren’t likely to be recouped.

“They didn’t just say they wanted to sell a lot. They capacitized to sell a lot,” said industry researcher Glenn Mercer, who leads Cleveland-based advisory firm GM Automotive. But the assumption of massive demand has proven foolhardy. And it failed to account for self-inflicted wounds that further stymied sales. Turns out the elephantine Cybertruck is either too large or non-compliant with some countries’ pedestrian safety rules, so there’s little opportunity to boost sales with exports.

“They haven’t sold a lot and it’s unlikely in this case that overseas markets can save them, even China that’s been huge for Tesla cars,” Mercer said. “It’s really just for this market.”

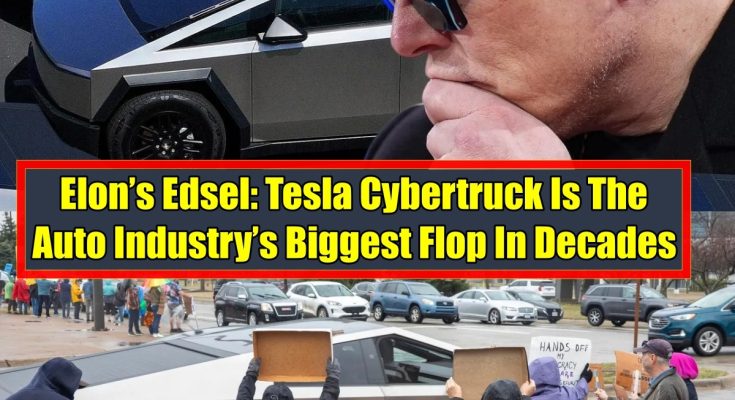

A Cybertruck drives by protesters at the Tesla Showroom in Somerset, Massachusetts.

UCG/Universal Images Group via Getty Images

More than a decade before Cybertruck went into production, Musk hinted that Tesla would eventually do some kind of electric pickup. When he unveiled his design to the world for the first time, Musk was clear that he did not want a conventional aesthetic or even something that played with pickup looks a bit but was still familiar, the approach Rivian took with its R1T pickup.

“Pickup trucks have been the same for 100 years,” and Cybertruck “doesn’t look like anything else,” said Musk, who earlier that month had proudly told an audience at a conference for space entrepreneurs, “I do zero market research whatsoever.”

That would be an apt tagline for Musk’s preposterous pickup. “The spectacular failure of Cybertruck was a failure of empathy,” said CARLAB’s Noble, whose company helps carmakers develop products based on consumer research. “Everything from the bed configuration to the cab configuration to its performance and all sorts of pickup truck duty-cycle issues, it’s just not empathetic to a pickup truck buyer.”

Cybertruck’s distinctive look resulted from two key forces, said a person familiar with the development process, who asked not to be identified because the information isn’t public. One was Musk’s passion for sci-fi designs. The other was an early decision to create a vehicle that didn’t need to be painted.

If Tesla opted not to paint the trucks, it wouldn’t need to install a new $200 million paintshop, a big potential cost savings. And it wouldn’t have to worry about EPA scrutiny from the harmful emissions and runoff those facilities often produce.

“They drooled over not spending $200 million on a paint shop, but probably spent that much trying to get the stainless steel to work.”

Glenn Mercer

Ultimately, Musk opted for a stainless steel exterior, the same choice Delorean made for his ill-fated sports car four decades earlier. But because Musk isn’t a production engineer, he may not have fully appreciated the challenges it presents versus aluminum or composite materials, the person said. Aside from the fact that stainless steel shows handprints–a common gripe about kitchen appliances–it’s hard to bend and likes to snap back to its original shape, one of the reasons there have been problems with Cybertruck body panels.“This is where I think they misconstrued the tradeoff,” Mercer said. “They drooled over not spending $200 million on a paint shop, but probably spent that much trying to get the stainless steel to work.”

Developing Cybertruck, including tooling expenses to make it in Austin, probably cost Tesla about $900 million, he estimated. And unlike the company’s other vehicles, like the Model 3 sedan and Model Y crossover, it doesn’t appear that the Cybertruck shares any development and production costs with other Tesla products.

“Does it have a demonstrated technology that could be used elsewhere by the company? That is not the case,” Mercer said. “Can the manufacturing plant make all this other stuff based on investments for Cybertruck? No, it can’t. An unpainted stainless steel vehicle just doesn’t have that much broad traction.”

There were bad omens from the start. At the vehicle’s unveiling in November 2019 to raucous Tesla fans in Los Angeles, a demonstration of Cybertruck’s supposedly shatter-proof “armor” glass by Musk and von Holzhausen went hilariously awry when a steel ball hurled at the vehicle busted the driver-side window twice.

“Oh my fucking God,” a chagrined Musk said. “We’ll fix it in post.”

Then there was the price. Musk had promised that a base version of the vehicle with 250 miles of range would start at $39,900. He was off by about half.

Currently, the base version of the truck, ostensibly priced from $72,490, costs $82,235 before a $7,500 federal tax credit that President Trump has vowed to eliminate. It claims up to 325 miles of range–if you don’t tow anything or drive too fast. The top-end “Cyberbeast” version is $105,735 and too pricey for the credit.

Though Tesla isn’t making the entry-level version Musk promised in 2019, plunging resale values have made used Cybertrucks quite a bit more affordable, according to auto news site Jalopnik. You can get a lightly used one for less than $70,000, assuming you’re comfortable with the implied risk of vandalism. And prices could go lower still, exacerbated by about $200 million of unsold inventory the company is sitting on, Tesla fansite Electrek said this week.

In the end, Musk cursed the Cybertruck by ignoring the reasons people buy pickup trucks — to haul things around and drive well in offroad conditions. The vehicle isn’t competent at either of those things, as has been endlessly documented in scathing reviews, a steady stream of “Cybertruck fail” videos and a 280,000-member “CyberStuck” Subreddit. Adding to the embarrassment is a developing sub-genre of videos showing stymied Cybertrucks being towed to safety by Ford F-150s or GM Silverados.

“If there’s anything the Detroit Three know how to do, it’s full-size pickup trucks with extremely loyal buyers,” Mercer said. “He launched Cybertruck into the teeth of the hardest segment to crack.”